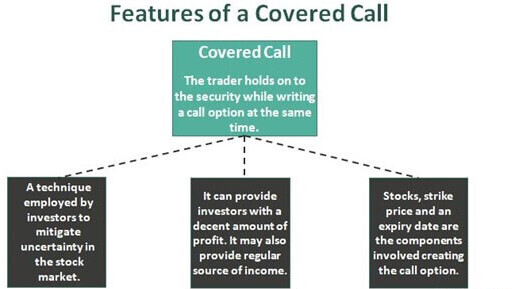

If you’ve been poking around the world of stock options, covered calls might have popped up on your radar. A covered call in its simplest form is an agreement where you sell a call option against the stock you already own. Think of it like subletting an apartment you own; you’re giving someone else the right to buy your stuff at a specific price within a set time frame.

Now let’s break it down. You need to understand the premium, which is what you pocket immediately when you write a covered call. It’s a bit like earning rent in advance. But remember, not all that glitters is gold; understanding the ins and outs of this trade is key.

Before jumping the gun and setting up a covered call, get your basics right. You need to be up to speed with some critical terms: strike price, expiration date, and delta. The strike price is where this deal is set in stone – it’s the price at which the option buyer has the right to purchase the stock. As for the expiration date, that’s the timeline of the whole gig. Delta gives you the likelihood of the option getting exercised.

People often throw covered calls in the same basket as other options strategies, but it’s a unique beast. Unlike naked calls or margined trades, covered calls come with the security of owning the underlying stock, which can be a safety net when the market throws a curveball.

Two Potential Outcomes and Strategies for Success with Covered Calls

Once you’ve got a covered call in play, you’re basically dealing with two potential outcomes. The first, and probably most straightforward, is when the stock just hangs out and doesn’t creep past your chosen strike price. In this scenario, you get to keep your shares and enjoy the premium you scooped up initially — it’s a win-win!

But let’s spice things up a bit: what if the stock shoots past your strike price? Well, the stock gets “called away,” meaning you sell it at the strike price. Not too shabby, considering you keep the original premium, plus you’ve bagged the increased value of the stock. The double win here is delightful.

Feeling the thrill? Great! Here’s the scoop to keep riding that wave. Consider a rinse and repeat approach, meaning you can get into a new covered call if the stock still fits the bill. Like a well-oiled machine, this might bring consistent returns.

To play it smart with your premiums, set a profit limit at around 90% of your premium. If things don’t go as planned and that strike price is creeping too close for comfort, think about rolling it over to the next expiration. This trick can help avoid losses and keep the ball rolling.

Deciding how to schedule these plays is the next step. Weekly trades keep things dynamic but need your attention. If you’re more of a set-and-forget person, monthly could be more your style.

Now, about that strike price. Aiming for 10 to 20% above the current price might do the trick. If you fancy keeping the stock, look at delta in the .15 to .2 range. Want to offload it? Tweak the delta upwards. Add a little strategy magic by setting a good till cancelled (GTC) order to buy back when it hits a 10% premium value.

After that, just sit tight and wait; once it triggers, you jump into the next setup. A little rinse, a little repeat, and you’re possibly on your way to mastering the art of covered calls without any sweat.