Running a Wheel Strategy on a stock like SOFI (SoFi Technologies) can be a fun and educational way to get a feel for options trading—even if you’re just using simulated trades and not risking real money. SOFI is a popular pick for this kind of strategy because it has a low share price, tons of liquidity in its options, and lots of option expiration dates to pick from. I’m going to walk you through exactly how the Wheel works, using SOFI as the example, along with some simulated numbers from June 24, 2025.

Why SOFI is a Good Candidate for the Simulated Wheel Strategy

I picked SOFI because its shares are usually under $10, (on 4/7/2025 shares closed at $10.71, the share price as of 8/8/2025 is $22) making it budget friendly for smaller accounts or simulated portfolios. Options are very actively traded, which means there’s no problem entering and exiting positions, and bid ask spreads are pretty tight a lot of the time. SOFI also gets a lot of attention from retail investors, which keeps the volume high. Whether you’re learning or just want an easy way to see the strategy play out, SOFI is worth a look.

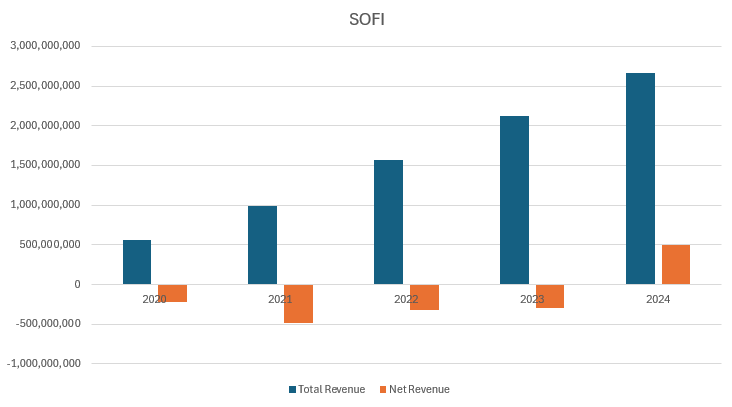

This chart shows :

- Strong Revenue Growth: SoFi’s total net revenue grew dramatically each year from 2020 to 2024. Revenues nearly doubled from 2020 to 2021 (increasing ~74% to $984.9 million) Growth remained high in 2022 (+60% year-over-year to about $1.57 billion) In 2023, revenue continued to rise, reaching roughly $2.12 billion (+35% vs 2022). By 2024, revenue hit $2.67 billion – almost five times the 2020 level – reflecting the company’s rapid expansion

- Profitability Trend: Despite surging revenues, SoFi recorded net losses from 2020 through 2023. The net loss widened in 2021 (–$483.9 million, up from –$224.1 million in 2020) as the company invested heavily in growth. However, losses narrowed thereafter – improving to –$320.4 million in 2022 and –$300.7 million in 2023. This trend of smaller losses indicated improving operating results over time.

- 2024 Profit Milestone: 2024 was the first year SoFi achieved a positive annual net income. The company posted $498.7 million in net profit for 2024, marking a major turnaround from prior years. Management noted that 2024 was SoFi’s “best year ever” financially, as it was the first full year of GAAP profitability for the company. This positive net income in 2024 reflects strong business growth and operational improvements, after several years of net losses.

All great indicators this company is a good candidate for the Wheel strategy.

On June 24, 2025, SOFI’s closing share price was around $7.50. Most Wheel strategies start by selling cash secured puts at or below the current share price, so it fits perfectly. You don’t need a giant amount of capital to get started, and the options premiums are still decent thanks to the stock’s movement.

The Starting Point: Writing a Cash Secured Put on SOFI

The first step in a Wheel Strategy is selling a cash secured put. You’re basically promising to buy 100 shares if the stock drops to your chosen strike price by the expiration date. If you’re simulating, pretend you’ve set aside $750 just in case you have to buy 100 shares at $7.50 each.

Say you decide to sell the July 5, 2025 $7.50 put. If SOFI options are trading with a $0.25 bid for that put, selling one contract could bring in a $25 premium (since each contract covers 100 shares). That $25 goes directly into your simulated account, lowering your cost basis if you end up assigned the shares.

- Capital Required: $750 (100 shares x $7.50 strike) held as cash reserve in your account.

- Premium Collected: $25 (before commissions).

- Outcome if the stock stays above $7.50: The put expires worthless. You keep the $25 and can sell another put next cycle.

- Outcome if the stock closes below $7.50: Assignment happens, and you’re now the proud owner of 100 shares of SOFI at $7.50 each.

If the Put Goes In The Money: Getting Assigned SOFI Shares

Suppose SOFI slips on earnings news, drops to $7.25, and your $7.50 put finishes in the money. If this were a real trade, your simulated account is debited $750 and now you own 100 SOFI shares. The $25 premium you collected effectively makes your net buy price $7.25 per share. It’s a small buffer, but every bit helps.

This part of the Wheel can freak out some traders. No one likes being assigned stocks they don’t want. With SOFI, though, the lower share price keeps your exposure pretty limited, and you still have the Wheel strategy’s next step to look forward to: selling a covered call.

Next Step: Opening a Covered Call on SOFI

Once the shares are in your account, you can flip around and start selling covered calls against those 100 shares. Maybe you turn to the July 26, 2025 $7.50 call. If that call is trading for about $0.30, you can sell it for a $30 premium.

- Shares Owned: 100 shares of SOFI at a cost basis of $7.25 (after put premium).

- Call Sold: July 26, 2025 $7.50 strike, collect $30 premium.

- Potential outcome if SOFI rises above $7.50: Your shares are called away (sold) at $7.50, plus you pocket the call premium.

- Potential outcome if SOFI stays below $7.50: The call expires, you keep your shares, and plan to sell another call next cycle.

What Happens If Assigned on the Covered Call?

If SOFI rallies to $7.60 or higher by expiration, your shares are called away. You sell them at $7.50. Here’s how the numbers line up:

- You bought the shares at $7.50, but remember, the $25 put premium dropped your net cost per share to $7.25.

- You collected $30 from selling the call.

- If SOFI is above $7.50, your shares get sold at $7.50 per share.

- Your total profit is $25 + $30 = $55 for the full Wheel cycle, not counting commissions.

On a $750 starting cash reserve, that’s a better than expected short term return. This is why lots of people run the Wheel on liquid, affordable stocks like SOFI. The risk and reward are pretty transparent, and each round of the Wheel gives you another shot at squeezing some extra dollars from sideways or slightly uptrending stocks.

Not Assigned? Rinse & Repeat the Wheel Strategy

If SOFI never crosses above $7.50 by your call’s expiration, you just keep your shares. This means your next move is to sell another covered call at a strike you like (sometimes $7.50 again, or maybe a bit higher if SOFI rises). The cycle can continue as long as you want, collecting call premiums. If SOFI ever gets called away on a rally, start the process over by selling another cash secured put at a strike that fits your plan.

A Simulated Timeline of the SOFI Wheel Strategy (June–July 2025)

- June 24, 2025: SOFI trading at $7.50.

- Sell July 5 $7.50 cash secured put, $0.25 premium collected ($25). Cash reserve $750.

- July 5, 2025: SOFI closes at $7.25. Assigned 100 shares at $7.50, cost basis after premium is $7.25 per share.

- Sell July 26 $7.50 covered call, $0.30 premium ($30) collected.

- July 26, 2025: SOFI closes at $7.60. Shares are called away, receive $750 back plus all collected premiums (total $55 profit).

There are plenty of ways this cycle can play out over months or even years, with the Wheel slowly accumulating small gains and lowering your cost basis with each new premium. Of course, SOFI could drop sharply and put you underwater. That’s the main risk if you get stuck holding shares for the long term—something every Wheel trader should keep in mind.

Things to Watch Out for When Using the Wheel Strategy on SOFI

- Assignment Risk: With SOFI’s stock price moving around a lot, you might get assigned more often than on a stable blue chip. Be comfortable owning the shares before selling puts.

- Premium Size: Lower priced stocks give smaller premiums, so profits per cycle can be limited. Still, the risk is lower, too, which makes SOFI a nice training ground for Wheel trading.

- Brokerage Fees: I always check what I’m paying in commissions and fees, especially on lower priced options. High fees can eat up most of your profit.

- Liquidity: SOFI options are pretty active, but super low volume out of the money strikes can have ugly bid ask spreads. It’s typically smarter to stick with the nearer money options.

Common Questions About Running the Wheel on SOFI

Question: What happens if SOFI keeps falling after assignment?

Answer: You’re still on the hook for those shares, and your cost basis is the strike minus total premiums collected. If SOFI heads lower, you can either keep selling covered calls at lower strikes or, in a simulated account, sit back and see how the Wheel shapes up over time. There’s downside, but every call premium helps offset it a bit.

Question: Can I pick a different strike if I don’t feel comfortable at the money?

Answer: No problem at all. Pick an out of the money strike (say, $7.00), which lowers your premium income but reduces the odds of assignment. On liquid names like SOFI, you’ll usually find reasonable premiums even slightly out of the money.

Question: How do I decide when to start the next Wheel cycle?

Answer: Once your shares get called away, check your cash balance and look for the next available put with a strike and expiration that makes sense for you. Jump back in with a new cash secured put and keep the cycle running.

Some Practical Tips for Using the Wheel on SOFI

- Keep Cash Ready: Every cash secured put requires the full amount of cash on reserve to meet assignment, even in simulated accounts.

- Track Every Transaction: In a spreadsheet or journal, jot down dates, strikes, premiums, and outcomes to get a real sense of results and learning points.

- Pay Attention to Volatility: SOFI premiums can fluctuate a lot based on market news and volume spikes. I like selling premiums when implied volatility is higher, but I’m always mindful that high volatility also raises assignment probability.

- Simulate Longer Scenarios: To really get a sense of how the Wheel works on SOFI, try running simulated trades over several months. Observe how rolling strikes or changing your put or call strategy during earnings season or major news can impact your outcomes.

- Compare with Other Stocks: For a broader grasp, run the Wheel on a couple different tickers alongside SOFI. This way, you can track down which stocks deliver the best balance of premium and risk for your options adventure.

Using the Wheel to Build Confidence in Options Trading

Running simulated Wheel strategies on SOFI or similar stocks is super useful for getting familiar with how options flow and how premiums accumulate over time. Watching the numbers add up, handling assignment, and tracking the cycles gives you way more confidence for the day you’re ready to trade with real money. Even if you never plan to run the Wheel live, practicing with these kinds of stocks builds your knowledge and helps you spot what works (and what doesn’t) about popular options strategies. Many traders stumble upon new insights by keeping a log of their simulated trades and comparing results over different timeframes or market moods, so always take a moment to reflect on your Wheel adventure.