If you’ve ever wanted to boost your stock returns while lowering your risk a bit, covered calls might be worth a closer look. I find covered calls to be one of the simplest and most approachable options strategies, especially for people who already own stocks and want to generate some extra income from them. Instead of just sitting on shares and waiting for price action, covered calls add a fresh income angle to your portfolio. If you’re curious about how this works or want a step-by-step walkthrough, I’m going to break down everything you need to know in a simple, direct way.

Even if you don’t have much experience with options, you can use covered calls to your advantage. Following a set method will help keep the process low-stress, straightforward, and even pretty interesting. This guide goes through the practical steps for executing a covered call from picking the right stock, to choosing the best strike price, to monitoring your trade. By the end, you’ll know exactly what to do and how to make smart decisions about each step.

Step 1: Check If Covered Calls Make Sense for You

Before making any trade, I always like to take a step back and check if the strategy lines up with my goals and portfolio. Covered calls work best if you already own shares of a stock, or if you’re comfortable buying 100 shares. This options method is mainly for people who want to earn income on shares they plan to hold for a while, but who aren’t dead set on holding through every kind of market movement.

However there are other options when planning to use a covered call in your portfolio. Its called The Wheel Strategy.

Ask Yourself These Questions First:

- Do I own at least 100 shares of a stock I’m willing to keep for a bit?

- Would I be fine if my shares are sold at a set price?

- Am I looking for extra cash flow, even if it means capping how much I can make if the stock soars?

Common Goals for Covered Calls

- Generating extra monthly or quarterly income

- Selling stocks you’re comfortable parting with, at a price you choose

- Adding a small safety net during calm or sideways markets

If your answers line up with those points, covered calls could be a practical fit for your strategy.

Step 2: Choose the Right Stock to Sell Calls Against

Covered calls start with picking stocks you already own, but not every stock is a good choice. Look for shares you wouldn’t mind letting go at a certain price, since your risk is having to sell if the stock rises above your chosen strike price. Stocks with steady prices, decent trading volume, and some options activity tend to work best. I like to use companies I trust and wouldn’t mind holding for several months.

Checklist for Choosing Stocks:

- Own at least 100 shares (per contract you want to sell)

- Stock has options with reasonable trading volume

- You’re comfortable selling at a higher set price

- The stock fits your long-term goals

Avoid picking extremely volatile stocks or those with a chance for sudden spikes, unless you’re ready to sell at your chosen price even if the stock surges. For most beginners, well-known companies with stable prices work best.

Step 3: Pick the Strike Price and Expiration Date

This step is where you set how much you’ll sell your shares for if the stock rises, and how far in the future you’ll give the buyer the right to buy at that price. The strike price is really important because it decides both the income you collect, and whether you might be forced to sell your shares.

How I Choose a Strike Price:

- I look for a strike price slightly above the current price. This means I collect a solid premium, but I also keep some upside if the stock goes up.

- If my goal is just income and I don’t care about selling, I aim for a strike price closer to the current price to maximize the premium.

- For conservative income, I use a strike price a bit further away from the current price. This lowers my income but reduces the chance my shares are called away.

For expiration, I usually stick to contracts that expire in two to six weeks. They often provide a good balance between time decay and premium income. Shorter contracts also let me repeat the trade more often if that fits my plan.

Quick Example:

If I own 100 shares of XYZ at $42, I might sell a call with a $45 strike price, expiring in one month. If the stock rises above $45 by then, I’m committed to selling. If not, I keep the shares and the premium.

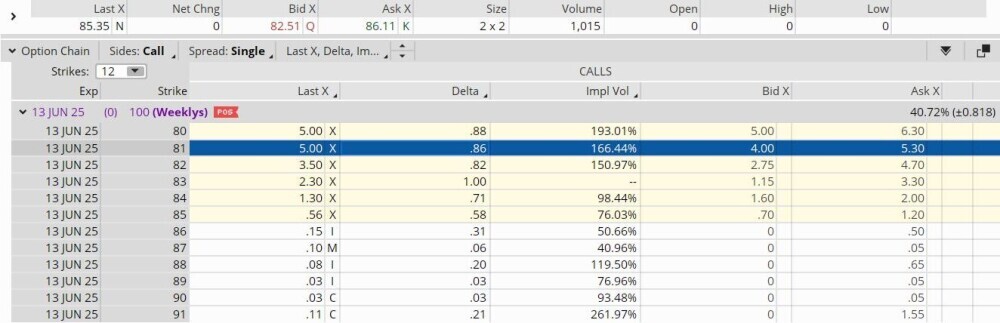

Example of an Options Trade Grid on ThinkorSwim

Example of an Options Trade Grid on ThinkorSwim

Step 4: Enter the Covered Call Trade

Actually placing the trade is not as complicated as it sounds once you know your numbers. Most broker accounts make this process simple. I just need to select the correct ticker, choose the “sell to open” call option, and review all the details before confirming.

Step-by-Step Covered Call Trade:

- Log into your brokerage account.

- Find the option chain for the stock you want to use.

- Select the call option with your chosen strike price and expiration.

- Click “sell to open” for one contract per 100 shares you own.

- Review the trade details carefully: symbol, strike, expiration, and quantity.

- Submit the order. If the market is open, the trade usually fills quickly.

Brokers may automatically hold your shares as collateral for the trade, so there’s nothing extra you need to do there. Double-check that you’re selling calls (not buying them by mistake), and only for stocks you own enough of.

Step 5: Manage the Trade Until Expiration

After selling a covered call, you can sit back and monitor the position. Your choices in this stage depend on how the stock moves and how you feel about keeping or selling your shares.

Possible Outcomes:

- The stock stays below your strike price by expiration: You keep your shares and the premium earned. You can repeat the covered call next month if you want.

- The stock rises above your strike price: Your shares are sold at the strike price. You still keep the premium, plus earn any gain up to the strike price.

- The stock falls in value: You still keep the premium, which does provide a buffer against the loss. If you still like the stock, repeat the trade next cycle.

I like to keep a close eye the last few days before expiration. If my stock is close to the strike, I think about rolling the call (buy it back and sell another with a future date), or just letting it play out if I’m fine selling at that price.

Step 6: Know the Risks and Things to Watch For

Every stock or options trade comes with some downsides, and covered calls are no exception. Understanding what could happen helps you make better decisions and avoid surprises.

Main Risks with Covered Calls:

- If the stock price soars far above the strike, you’ll miss out on gains above the strike price.

- If the stock drops sharply, you still take a loss, but the premium helps soften that amount compared to holding shares alone.

- Your stock could be called away at any time before expiration on ex-dividend dates, or if the option is deep in the money. This is rare, but not impossible.

I always remember that once I sell a call, my upside is capped. I only use this strategy on stocks I’m comfortable owning, even if prices fall, but wouldn’t mind selling at my strike.

Step 7: Tips for Staying Consistent and Improving Over Time

It took a few cycles before I felt totally comfortable with covered calls. Over time, I learned a few habits that helped me stay consistent and avoid common mistakes.

What’s Helped Me:

- Track every trade, including premiums earned, assignment dates, and results.

- Start small and build confidence before increasing your positions.

- Adjust strike prices and expirations as you get more familiar with market moves and your own comfort with risk/reward.

- Stay away from stocks you wouldn’t be happy to own even if the price falls.

The more you practice, the more these trades become part of your regular investment routine. I also like to check out official educational pages and broker resources for the latest updates or changes to options trading rules. For additional insights, financial forums and community discussions can offer valuable peer perspectives and real-life case studies.

Common Questions & Troubleshooting

Can I sell covered calls on stocks I don’t own?

You need to own at least 100 shares per contract to make this strategy “covered.” If you sell a call without owning shares, that’s called a naked call, which carries a lot more risk. I stick to covered calls for safer, income-focused trades.

What happens if the stock drops a lot?

I still keep the premium I collected, which helps offset the loss, at least a bit. Covered call selling works best when you stay with solid, stable stocks and don’t mind holding if prices dip.

Can I buy back the call option before expiration?

Yes. If I want to keep my shares but see the stock nearing my strike, I can buy back the call (it may cost more than what I sold it for if the price ran up). I sometimes do this if my outlook changes.

Final Tips & Next Steps for Covered Calls

Covered calls fit into a steady, income-producing portfolio. By following the steps above, I can collect regular premiums, improve my returns a bit, and keep control over my stocks. As I build experience, covered calls have become a comfortable part of my investment toolbox.

Your Simple Covered Call Plan:

- Pick one stock you own 100 shares of and look at the available call options.

- Choose a strike and expiration that fits your comfort level.

- Sell your first covered call and see how it plays out.

If you have questions about specific covered call trades, or if you want to share your own experience, I’d love to hear about it below. By using these steps and keeping a record of each trade, you’ll steadily build knowledge. Over time, you may even develop your own method for choosing strikes and expirations, helping you get the most out of your covered call strategy.